nc state sales tax on food

Do not include these receipts rentals and sales on Lines 9 10 or 11. 425 sales tax rate permanent 2008.

Did South Dakota v.

. Goods sold by artisan bakeries without eating utensils are considered non-taxable at the state level though they are subject to the 2 local sales tax just like groceries. NC Department of Revenue Notice. 575 sales tax rate Medicaid Swap.

This page describes the taxability of food and meals in North Carolina including catering and grocery food. The 2018 United States Supreme Court decision in South Dakota v. Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy.

They are Arkansas. State General Sales Tax Rate Changes 1933. The story called life.

Counties and cities in North Carolina are allowed to charge an additional local sales tax on top of the North Carolina state sales tax. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Sales Use Tax Effective March 1 2021 State Surplus sales are subject to sales use tax as determined by NC Dept of Revenue.

The credit allowed by this subdivision does not apply to tax paid to a state that does not grant a similar credit for sales or use taxes paid in North Carolina. 4 sales tax rate 2001. Line 8 - Enter the total amount of your taxable receipts rentals and sales of food products exempt from State tax but subject to the local 2 rate of food tax.

Thirty-one states and the District of Columbia exempt most food purchased for consumption at home from the state sales tax. It is sold in a heated state It consists of two or more foods Foods mixed or combined by retailer It is sold with eating utensils Prepared Food. 45 sales tax rate temporary 2006.

The Asheville sales tax rate is. A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. For a better understanding of what constitutes as an unprepared food below are additional resources.

North Carolina has a 475 statewide sales tax rate but also has 459 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222 on top of the state tax. This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax. This general rate applies to food prepared and consumed on the premises of full service restaurants and other retail establishments such as taverns and fast food shops that serve food.

Back to the story problem that really happened. Groceries gas or prescription medication purchases. The following is a list of the states that do tax groceries and if applicable which ones apply a special rate on grocery items.

105-164328 Subject to the State and local sales tax if. Of the states with sales taxes. Our creditbank card processor will be adding a 275 managed convenience fee for all card transactions.

425 sales tax rate temporary 2007. Select the North Carolina city from the. You can find more examples of when prepared food is and is not taxable in Section 32 of the latest North Carolina Sales and Use Tax Bulletin.

Student dining plans are now being taxed at the combined state and Durham county rate of 75. The North Carolina sales tax rate is currently. Has impacted many state nexus laws and sales tax collection requirements.

55 sales tax rate temporary 2009. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. NC General Statute 105-16413B.

Three stores Krishna Food Mart Kims Grocery and Jays Grocery charged 7 cents. 3 sales tax rate 1991. 45 sales tax rate Medicaid swap 2009.

Both the charge for the dining plan and the tax surcharge will be listed separately on students bursar bills. Ad Automate Standardize Taxability on Sales and Purchase Transactions. To learn more see a full list of taxable and tax-exempt items in North Carolina.

The funds for the meal plan and the NC Sales Tax Surcharge are added to the students DukeCard food point account. Taxation of Food and Prepared Food. The County sales tax rate is.

WFMY in North Carolina reports that half of a random sampling of stores 5 out of 10 charged too much sales tax on Kit Kats. The Tax Foundation is often asked which states exempt certain items from their general sales taxes especially as they relate to food. Food exempt from tax.

92 out of the 100 counties in North Carolina collect a local surtax of 2. Sheetz and Summit Shell Xpress Mart charged 8 cents. The local-option sales tax does not apply to unprepared food ie.

South Carolina is the state that most recently eliminated its sales tax on food effective November 1 2007. Sales and use tax rate State rate 0 Local rate 2 State exemption 5822 M Local revenue 2624 M Prepared Food DefinitionGS. 35 rows Alexander.

31 rows The state sales tax rate in North Carolina is 4750. The transit and other local rates do not apply to qualifying food. Sales Tax Breakdown.

North carolina 475 4 north dakota 5 ohio 575 oklahoma 45 oregon none -- -- --pennsylvania 6 rhode island 7 south carolina 6 south dakota 45 tennessee 7 4 4 texas 625 utah 61 5 30 5 vermont 6 virginia 53 2 25 2 washington 65 west virginia 6 wisconsin 5 wyoming 4 dist. North Carolina has recent rate changes Fri Jan 01 2021. 338 effective October 1 2005.

With local taxes the total sales tax rate is between 6750 and 7500. Seven states tax groceries at lower rates than other goods. D e Repealed by Session Laws 2005-276 s.

Integrate Vertex seamlessly to the systems you already use. Wayfair Inc affect North Carolina. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants.

Sales Tax On Grocery Items Taxjar

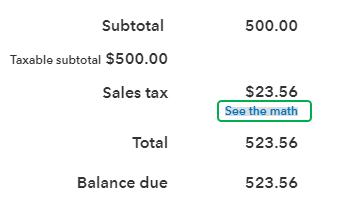

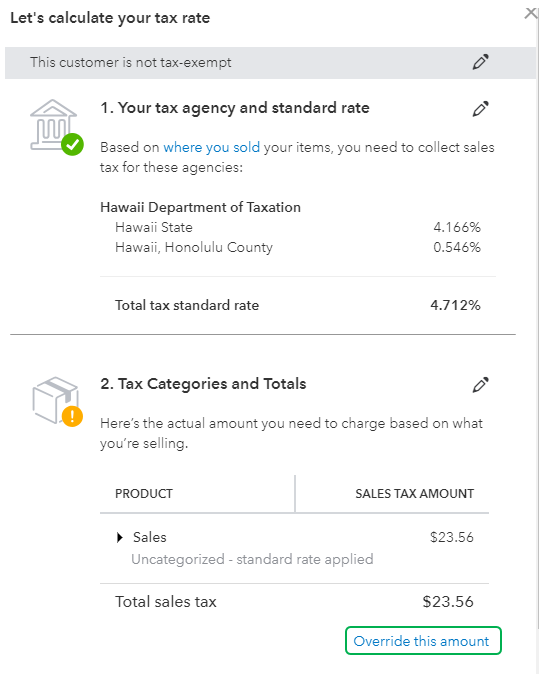

Solved Should I Enter My Sales Tax As An Expense Every Time I Pay It Or Is That Automatically Figured Into My Profit And Loss Statement From The Sales Tax Program

Hunam Chinese Restaurant Chapel Hill Nc 27514 Menu Chinese Online Food Delivery Catering In Chapel Hill Online Food Serving Wine Chinese Restaurant

The Tampon Tax Is Real These Are The 40 States Taxing Periods Tampon Tax Tampons Tax

Gameday Ncsu Women S Boot Ncs L052 1 Womens Boots Boots Gameday Boots

Sales Tax On Grocery Items Taxjar

Home Depot Sales Tax On Tool Rental Home Depot Sales Home Tools Rental

Florida Taxes Map Of Florida Beaches Florida County Map Map Of Florida Cities

How To Calculate Sales Tax Backwards From Total

Sales Tax On Grocery Items Taxjar

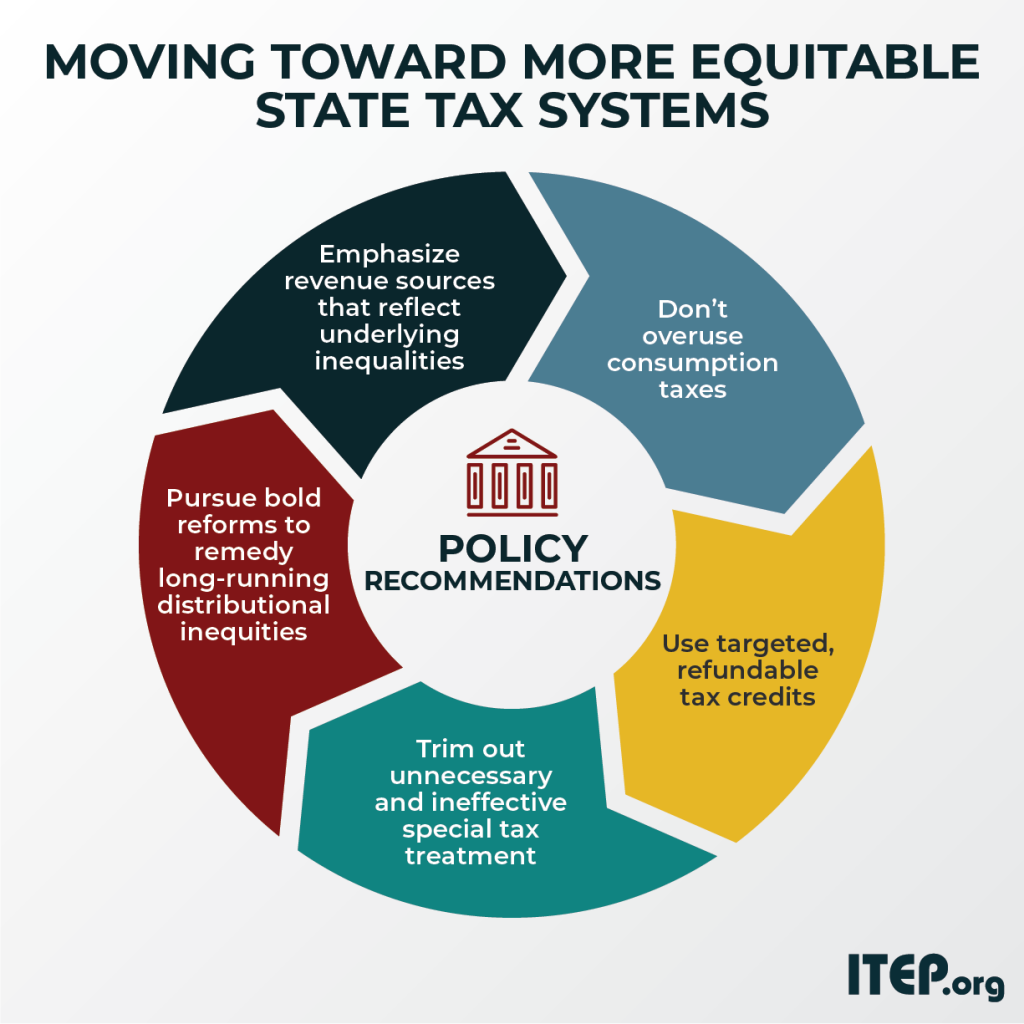

Moving Toward More Equitable State Tax Systems Itep

Review Flame Tree Barbecue At Disney S Animal Kingdom The Disney Food Blog Disney Food Blog Animal Kingdom Disney Food

Solved Should I Enter My Sales Tax As An Expense Every Time I Pay It Or Is That Automatically Figured Into My Profit And Loss Statement From The Sales Tax Program

How To Calculate Sales Tax Backwards From Total

Oklahoma Sales Tax Small Business Guide Truic

Thanksgiving Brunch At Blue Restaurant Bar Uptown Charlotte Nc Fresh Cranberry Sauce Brunch Restaurants Thanksgiving Brunch